Best current Authors

Every two quarters or so I like to aggregate my thoughts on the publicly traded REIT sector. I have been an investor in the space for many years and as a professional analyst often review real estate portfolios and transactions related to the sector.

Every two quarters or so I like to aggregate my thoughts on the publicly traded REIT sector. I have been an investor in the space for many years and as a professional analyst often review real estate portfolios and transactions related to the sector.

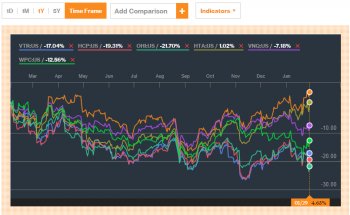

I currently maintain positions in W.P. Carey Inc. (NYSE:WPC), Physicians Realty Trust (NYSE:DOC), Ventas, Inc (NYSE:VTR), HCP Inc. (NYSE:HCP), Omega Healthcare Investors, Inc. (NYSE:OHI), and Healthcare Trust of America Inc. (NYSE:HTA). It is clear I am overweight the healthcare sector thought his has not always been the case. This will be a good time to review if those allocations should be maintained or if there are now better opportunities. Some of these positions have been built strategically over several years while others are less than a year old. Let's evaluate how they've performed versus a couple measuring sticks.

Click to enlarge

Click to enlarge

Source: Bloomberg.com

Only HTA and DOC (in orange) outperformed the U.S. healthcare ETF. The strength of healthcare REITS long-term is tied to the profitability and growth of the healthcare sector. Short and medium-term, however, they are only loosely correlated. Let's take a look at the broader REIT sector.

DOC and HTA again outperformed the benchmark while the others lagged by 5.4% (W.P. Carey) to 14.5% (Omega Healthcare Investors). This healthcare weighted REIT portfolio has outperformed both the healthcare sector as well as the broader REIT index. My largest allocation over the last 18 months has consistently been DOC due to my personal expectations that the firm would improve its distribution coverage ratio while continuing its rapid growth. This has fortunately came to fruition.

Physicians Realty Trust

I added to my DOC position when it broke through $15 back in June.

DOC has not been a public firm for very long. Its long-term chart reinforces my aforementioned thoughts about the firm.

DOC has not been a public firm for very long. Its long-term chart reinforces my aforementioned thoughts about the firm.

Click to enlargeThe stock has earned a compound annual growth rate ("CAGR") of 20% since its IPO and is within striking distance of its all-time high.

These returns are justified as DOC has grown its asset base from an IPO value of $124 million to over $1.5 billion currently. Net leasable square footage has grown over 10 times from half a million to over 5 million square feet. Has the firm's market capitalization kept pace with its tremendous growth? Almost but not quite.

Its $135 million IPO value has grown to over $1.8 billion (including follow-on offerings) while improving its geographic (now invested in over 20 states with Texas the highest at 13%) and facility diversification (19 properties to over 130) substantially. Its portfolio is concentrated in medical office buildings ("MOBs") with its largest investment in Single-tenant (32.5% by square feet) and Multi-tenant (54.4%) facilities with smaller allocations to hospitals (5.1%) and LTACHs (5.9%).

RELATED VIDEO

Share this Post

Related posts

Famous Current Authors

On Monday, Donna Tartt won the Pulitzer Prize for Fiction for The Goldfinch. It was no surprise, really, since the much-anticipated…

Read MoreList of American Literature authors

The tradition of storytelling has always been a fundamental part of Native American life. The history of oral tradition is…

Read More